Types of cryptocurrency

In 2018, an increase in crypto-related suicides was noticed after the cryptocurrency market crashed in August. The situation was particularly critical in Korea as crypto traders were on “suicide watch”. https://replaysofthestorm.com/ A cryptocurrency forum on Reddit even started providing suicide prevention support to affected investors. The May 2022 collapse of the Luna currency operated by Terra also led to reports of suicidal investors in crypto-related subreddits.

Cryptocurrencies have been compared to Ponzi schemes, pyramid schemes and economic bubbles, such as housing market bubbles. Howard Marks of Oaktree Capital Management stated in 2017 that digital currencies were “nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it”, and compared them to the tulip mania (1637), South Sea Bubble (1720), and dot-com bubble (1999), which all experienced profound price booms and busts.

Almost 74% of ransomware revenue in 2021 — over $400 million worth of cryptocurrency — went to software strains likely affiliated with Russia, where oversight is notoriously limited. However, Russians are also leaders in the benign adoption of cryptocurrencies, as the ruble is unreliable, and President Putin favours the idea of “overcoming the excessive domination of the limited number of reserve currencies.”

Business, government, and job impersonators In a business, government, or job impersonator scam, the scammer pretends to be someone you trust to convince you to send them money by buying and sending cryptocurrency.

New cryptocurrency

On this page, you can find out the name of the latest digital currencies, their symbol and when they were added. It can take a little time to get data on a coin’s market cap and its circulating supply initially, but we’ll update that data as soon we get it.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free – so that you can make financial decisions with confidence.

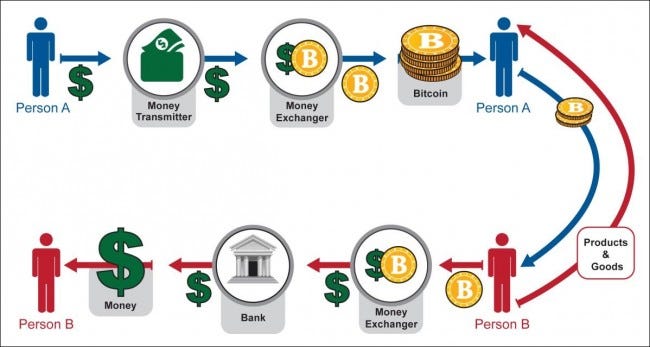

Cryptocurrency is based on blockchain technology. Blockchain is a kind of database that records and timestamps every entry into it. The best way to think of a blockchain is like a running receipt of transactions. When a blockchain database powers cryptocurrency, it records and verifies transactions in the currency, verifying the currency’s movements and who owns it.

While Bitcoin has been a major player in the market for over a decade and the opportunity for early investment has passed, new projects like Blast, Dogwifhat, and Starknet are currently gaining traction. Buying new cryptocurrencies can make you profits when those projects become successful.

How does cryptocurrency work

Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each other through an online system. Cryptocurrencies have no legislated or intrinsic value; they are simply worth what people are willing to pay for them in the market. This is in contrast to national currencies, which get part of their value from being legislated as legal tender. There are a number of cryptocurrencies – the most well-known of these are Bitcoin and Ether.

In April 2024, TVNZ’s 1News reported that the Cook Islands government was proposing legislation that would allow “recovery agents” to use various means including hacking to investigate or find cryptocurrency that may have been used for illegal means or is the “proceeds of crime.” The Tainted Cryptocurrency Recovery Bill was drafted by two lawyers hired by US-based debt collection company Drumcliffe. The proposed legislation was criticised by Cook Islands Crown Law’s deputy solicitor general David Greig, who described it as “flawed” and said that some provisions were “clearly unconstitutional”. The Cook Islands Financial Services Development Authority described Drumcliffe’s involvement as a conflict of interest.

Like bitcoin, ethereum is both a software and a cryptocurrency (ETH) powering that software’s network. It is considered by many to be the most popular altcoin (short for “alternative coin,” a.k.a., any non-bitcoin cryptocurrency).

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each other through an online system. Cryptocurrencies have no legislated or intrinsic value; they are simply worth what people are willing to pay for them in the market. This is in contrast to national currencies, which get part of their value from being legislated as legal tender. There are a number of cryptocurrencies – the most well-known of these are Bitcoin and Ether.

In April 2024, TVNZ’s 1News reported that the Cook Islands government was proposing legislation that would allow “recovery agents” to use various means including hacking to investigate or find cryptocurrency that may have been used for illegal means or is the “proceeds of crime.” The Tainted Cryptocurrency Recovery Bill was drafted by two lawyers hired by US-based debt collection company Drumcliffe. The proposed legislation was criticised by Cook Islands Crown Law’s deputy solicitor general David Greig, who described it as “flawed” and said that some provisions were “clearly unconstitutional”. The Cook Islands Financial Services Development Authority described Drumcliffe’s involvement as a conflict of interest.

Cryptocurrency jamie dimon

Dimon is one of the few bank chief executives to have become a billionaire, largely because of his stake in JPMorgan Chase. He received a $23 million pay package for fiscal year 2011, more than any other bank CEO in the US. However, his compensation was reduced to $11.5 million in 2012 by JPMorgan Chase following a series of controversial trading losses that amounted to $6 billion. On January 24, 2014, it was announced that Dimon would receive $20 million for his work in 2013; a year of record profits and stock price under Dimon’s reign, despite significant losses that year due to scandals and payments of fines. The award was a 74% raise, which included over $18 million in restricted stock.

In March 2000, Dimon became CEO of Bank One, the nation’s fifth largest bank. When JPMorgan Chase merged with Bank One in July 2004, Dimon became president and chief operating officer of the combined company. On December 31, 2005, he was named CEO of JPMorgan Chase, and on December 31, 2006, he was named chairman and president. In March 2008, he was a Class A board member of the Federal Reserve Bank of New York. Under Dimon’s leadership, with the acquisitions during his tenure, JPMorgan Chase has become the leading U.S. bank in domestic assets under management, market capitalization value and publicly traded stock value. In 2009, Dimon was considered one of “The TopGun CEOs” by Brendan Wood International, an advisory agency.

Trump also didn’t rule out considering Dimon for U.S. Treasury secretary if he retakes the White House in November, saying he has “a lot of respect for Jamie Dimon.” JPMorgan declined to comment on Trump’s remarks when asked by Reuters.

Dimon described the settlement as “unfair,” and said he “had to control his rage” regarding the topic, with most of the government claims against his company being for dealings that took place at companies before JPMorgan Chase bought them, as a result of the financial crisis. It is estimated that 70–80% of the dealmaking for the settlement was due to the outstanding legal exposures of Bear Stearns and Washington Mutual, which JPMorgan Chase had acquired at the encouragement of Treasury Secretary Hank Paulson, New York Fed President Timothy Geithner and other federal officials who helped broker the acquisitions, encouraged communication among the parties and even contributed financially to facilitate the transactions.

While the JPMorgan boss said his bank cannot lend against crypto assets, he is certain some customers still have access to crypto services via the bank. “If you want to do it, it’s a free country, do what you want,” he postulated.